Initiate your child’s savings journey with these straightforward and efficient programs, as advised by the Good Enough Mom.

Table of Contents

It is our aspiration for our children to possess a comprehensive understanding of financial matters. In an era marked by rising costs, the most effective method to instill principles of saving and budgeting in our children is to exemplify these practices ourselves.

My goal is to ensure a secure future for my son, enabling him to pursue his aspirations. While the plethora of financial advice from social media influencers can appear daunting, particularly with their intricate terminology and promotion of various investment schemes, there is no cause for concern. Traditional government programs serve as an excellent foundation, and I will delineate the most beneficial options available. The interest rates for the plans discussed are current as of April 1, 2024.

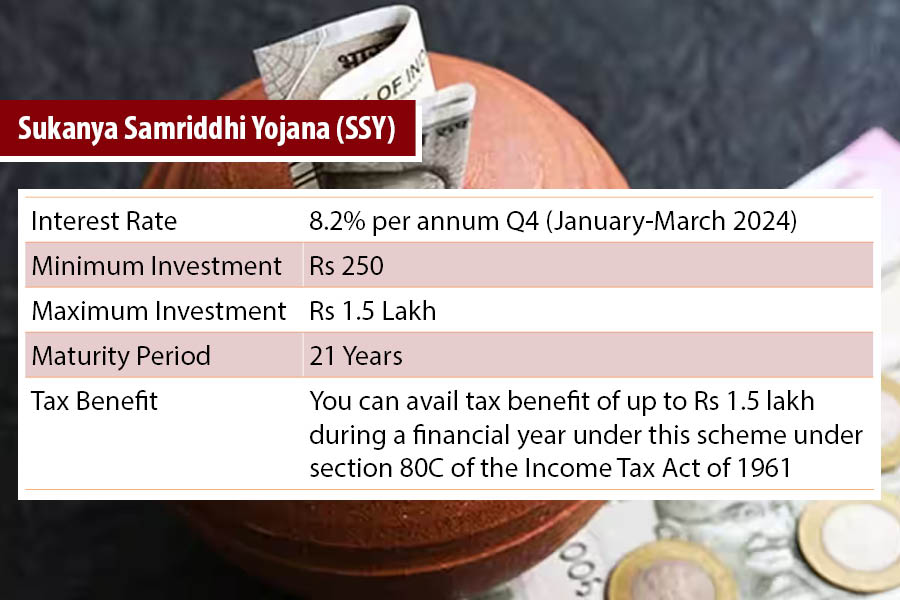

Sukanya Samriddhi Yojana..

In 2015, the Government of India introduced the Sukanya Samriddhi Yojana, a savings initiative aimed at motivating parents to set aside funds for their daughters’ education and marriage. Parents can open an account at any post office or authorized bank until their daughter reaches the age of 10. The scheme permits a maximum annual deposit of Rs 1.5 lakh, with a minimum deposit requirement of Rs 250. Upon reaching the age of 21, the account matures, allowing the daughter to withdraw the entire amount for educational purposes or wedding expenses.

Additionally, partial withdrawals are permitted after the age of 18. This scheme offers a compounded interest rate of 8.2 percent, which is the highest among small savings schemes.

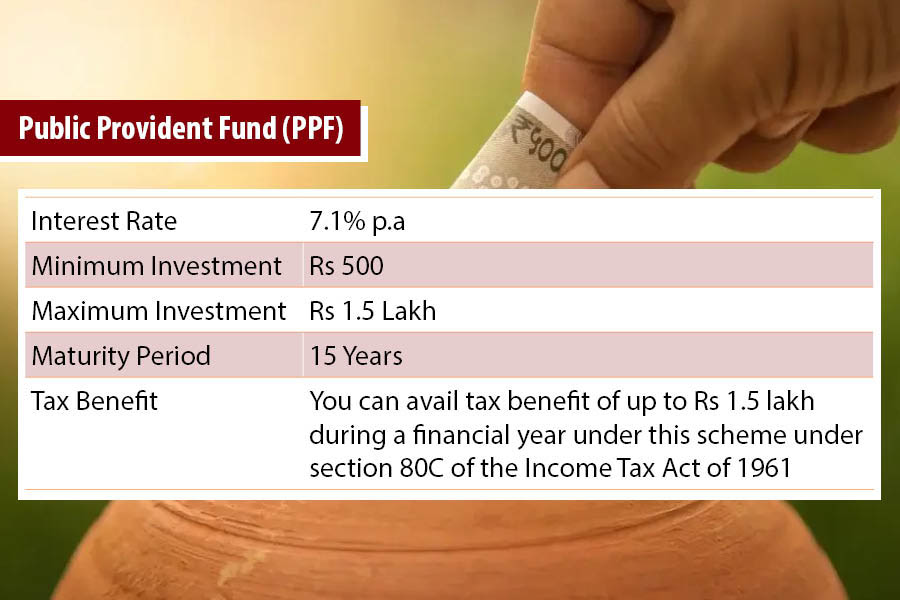

Public Provident Fund (PPF)

This investment scheme, established in 1968, serves as a significant avenue for tax savings. As an investor, one can continue to contribute to this fund and benefit from the scheme for a duration of 15 years.

Any Indian citizen, including minors, can open a PPF account at designated post offices or authorized banks. The minimum annual deposit is set at Rs 500, while the maximum limit is Rs 1.5 lakh. Investors have the option to make deposits on a monthly, quarterly, or half-yearly basis. The government reviews and sets the interest rate on PPF deposits every quarter, with the current rate being 7.1 percent per annum. Interest is compounded annually, meaning that the interest accrued is added to the principal at the end of each financial year, and the subsequent year’s interest is calculated on this new principal amount. Partial withdrawals are permitted after a period of seven years.

Investing in a PPF account is an excellent strategy for ensuring the financial security of children, as it offers numerous benefits.

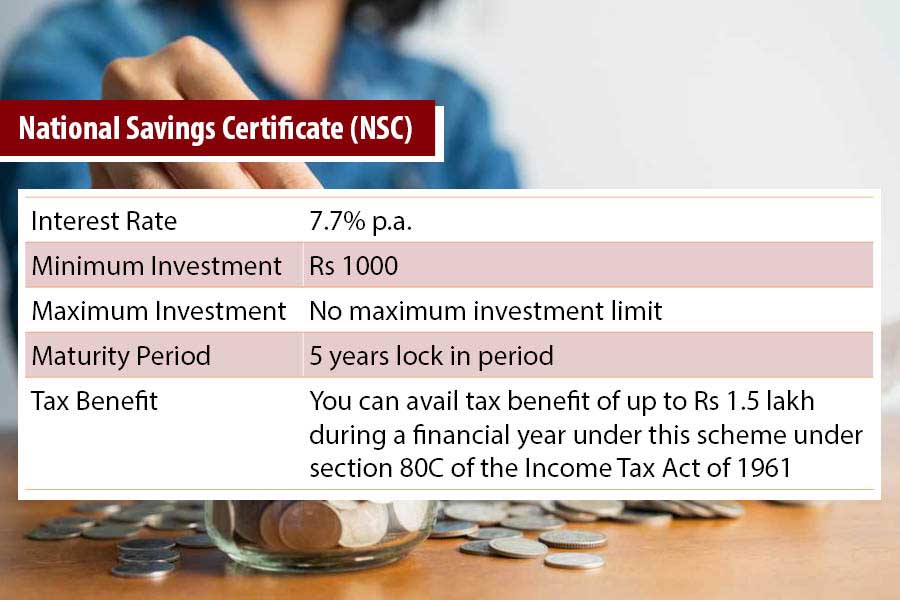

National Savings Certificate (NSC)

The National Savings Certificate (NSC) is an initiative by the Government of India that offers a fixed-income investment option, which can be easily opened at any post office while also providing tax-saving benefits. The minimum investment to initiate an NSC account is Rs 1,000, with subsequent deposits allowed in increments of Rs 100. There is no upper limit on the amount that can be invested in NSC accounts. Both individuals and minors aged 10 years and older are eligible to invest in the NSC, with legal guardians or parents permitted to invest on behalf of minor children. Currently, the NSC scheme is offered in two formats: electronic mode (e-mode) and passbook mode.

These certificates can be obtained from public sector banks, select authorized private banks, or post offices. For individuals who hold a savings account at an authorized bank or post office, the NSC can be conveniently purchased online in e-mode, provided that internet banking is enabled.

Kisan Vikas Patra (KVP)

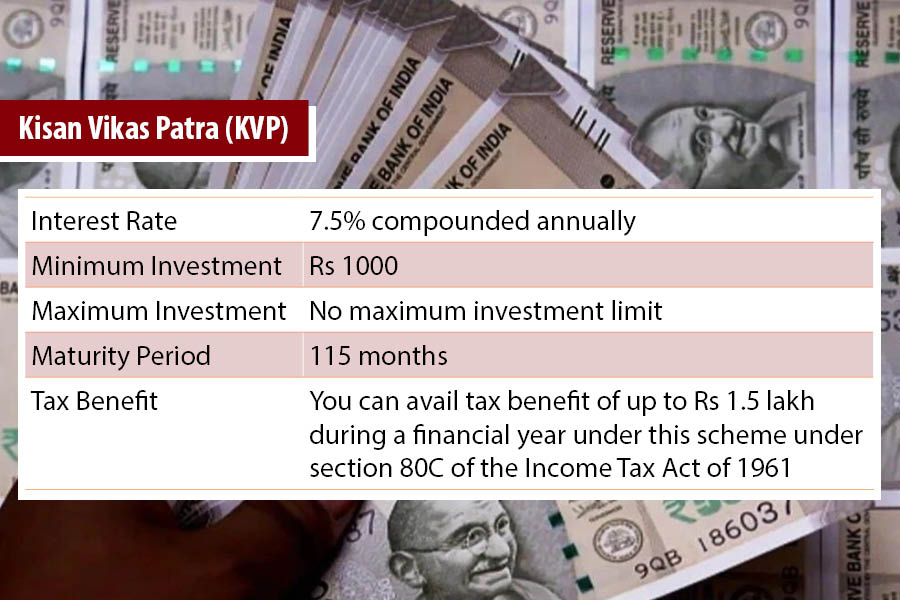

Kisan Vikas Patra was launched in 1988 as a savings initiative by India Post, primarily aimed at encouraging individuals to cultivate a long-term saving habit. Indian citizens aged 18 and above are eligible to participate, and parents or legal guardians may apply on behalf of minors.

The scheme has undergone several amendments, with the most recent adjustment establishing a tenure of 115 months, equivalent to nine years and four months, and an interest rate of 7.5 percent per annum. Legal guardians can manage the account for minors. The minimum investment is set at Rs 1,000, with no upper limit, although investments must be made in increments of Rs 1,000. For amounts exceeding Rs 50,000, the provision of PAN details is required at the local head post office. The invested amount is expected to double within the 115-month period, with withdrawals permitted only after the completion of the tenure.

Government initiatives are designed to promote financial stability, support educational expenses, and encourage secure long-term savings for children. These schemes are user-friendly, necessitating minimal documentation, and serve as a foundation for establishing a financial safety net for young individuals. Available at all post offices and select banks across the country, they contribute significantly to building a brighter financial future.